Let me tell you a story and like all stories it begins with...Once Upon a Time there were three piglets Crypto, NFT and DeFi who went out into the world and piggybacked(pun intended) on BlockchainSow(the mommy pig) to create something which would transform the lives of so many.

We will view through the prism of BlockchainSow and see what unexpected challenges she and her piglets solved to usher in a revolution called GameFi, which would onboard the next 100 million users on-chain.

A Flashback

BlockchainSow reminisces her past and begins it with a soliloquy:

I live in a country with a population of 6.5 million but almost 2 million of its citizen live and work abroad today including me. We work hard overseas to send money back so that our families can get by and also contributing to country's GDP .In fact, around 20% of the country’s GDP could be attributed to remittances alone. Believe me when I say, it took me two months to get my Identity card and total of three months to set up a bank account as an immigrant in this country. Oh woe be me! Don't ask me to go inside the flashback of flashback to know how barely I managed and transferred money to my family back home. But sending money through the banks and wires were very expensive and tedious affair.

As a technology enthusiast ,the inefficiencies bothered me.

According to the World Bank, remittance of $200 can incur average fees between 5% and 9%, depending on the countries involved and the mode of service used. You indirectly have to pay for complying with “Know-Your-Customer” (KYC) requirement, Anti-Money Laundering regulations, capital controls, and a whole bunch of other things and to top that transfer takes a day or two , yes business days only! As a developer, softwares I create go through several iterations and version upgrades until they become what users want them to be but how did money still was version 1.0 , not even 1.0.1?

I had to do something.

Something inevitable was brewing inside me.

One fine day, I met my future husband SatoMoto who showed me my true potential and we gave birth to a piglet we named Bitmoneda.

It wasn’t like your regular currency. A digital currency wrapped in features :

No central authority to control it

Nobody decides who gets to transact with the currency (theoretically available to everyone irrespective of your nationality)

Nobody can sneak into the network and tamper records.

And these transactions are anonymous.

Together we believed we had created an alternative to central banking and an irreplaceable store of value.

Cut back to today, with the great crypto crash of 2018 and the ongoing pandemic, it hit us hard .I had to return back to my origins but there was nothing much to do and it was getting harder to sustain my family. I had also given birth to two other piglets: NFTs and DeFi .

NFTs and DeFi

For the uninitiated, NFTs are Non-Fungible Tokens. Consider exchanging 10$ notes with somebody having another 10$ notes and it would be indistinguishable because they hold equal value. It’s what economists call a fungible token.

However you can't exchange Non-fungible tokens this way because they are unique and if they are created on an immutable ledger(Blockchain me), it becomes non-fungible.

If you are a proud owner of 'The Starry Night' painted by Van Gogh himself, would you exchange it with the JPEG of the painting I downloaded from Internet and got it framed?

If a NFT is assigned to you on an immutable ledger maintained by distributed consensus, will always belong to you unless you choose to dispense with the ownership.

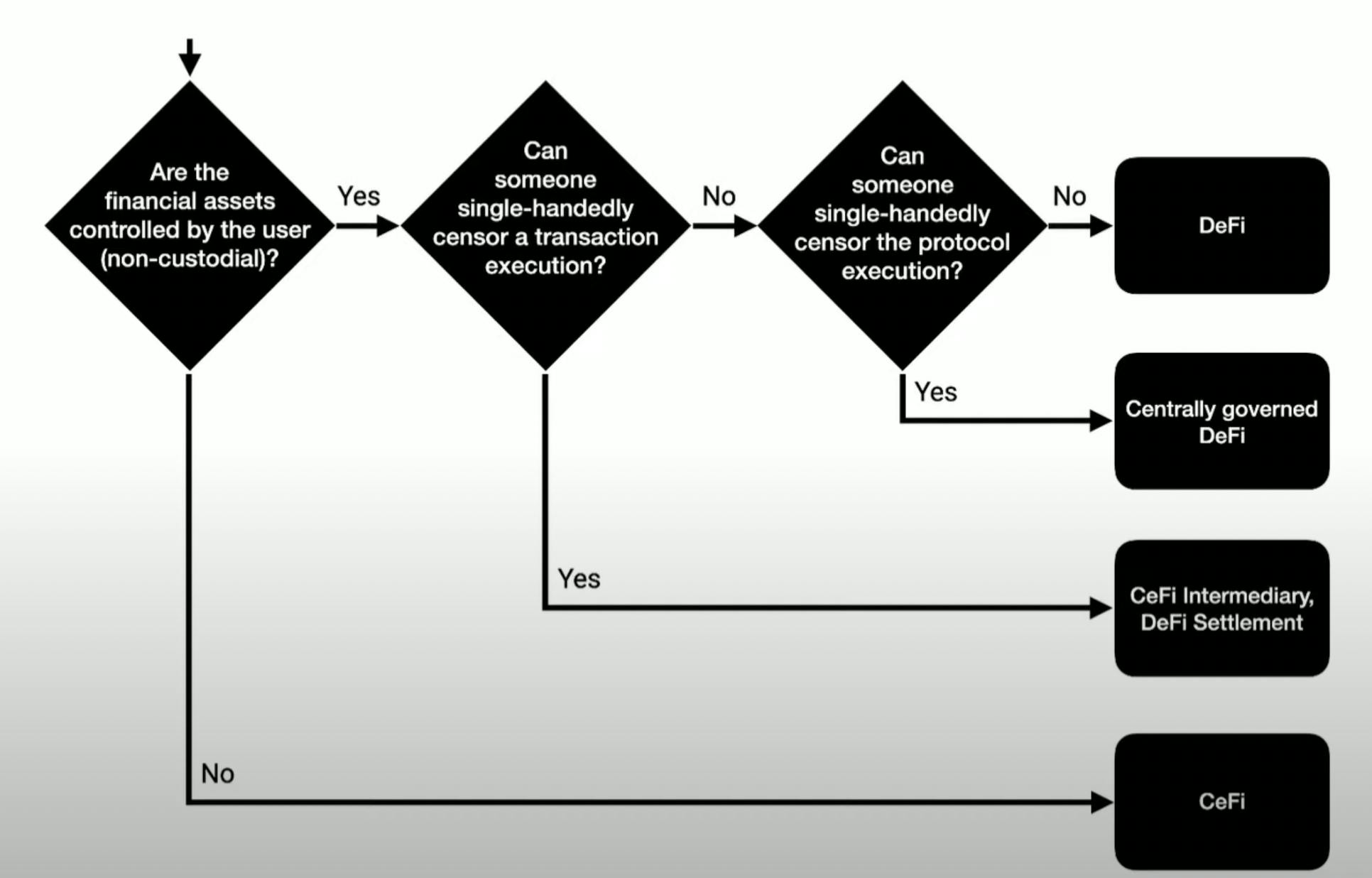

DeFi aka Decentralized Finance is an emerging fintech utilising the blockchain and crypto tokens. In simple terms:

Banks = Centralised Financial Institution

Products: Loan (Lending), Stocks, Forex

DeFi = Decentralized Financial Platform

Products are the same as banks, but fully owned by the People and the financial products are all built on chain and all governed by code! Code is law.

Ok back to the world I created .

Searching frantically for a job to earn my bread and butter, I heard about a new kid in the town: Axie Infinity, A blockchain based pokemon-inspired game where players can collect fantasy creatures called “axies”. Each Axie is represented as a non-fungible token and are publicly tradable on internet marketplaces. Best thing you could play to earn and get rewarded with SLP tokens which could be traded into dollars or even better: shops across my town accepted SLP tokens as payment .

That's the world me and SatoMoto had visualised when we created Bitmoneda.

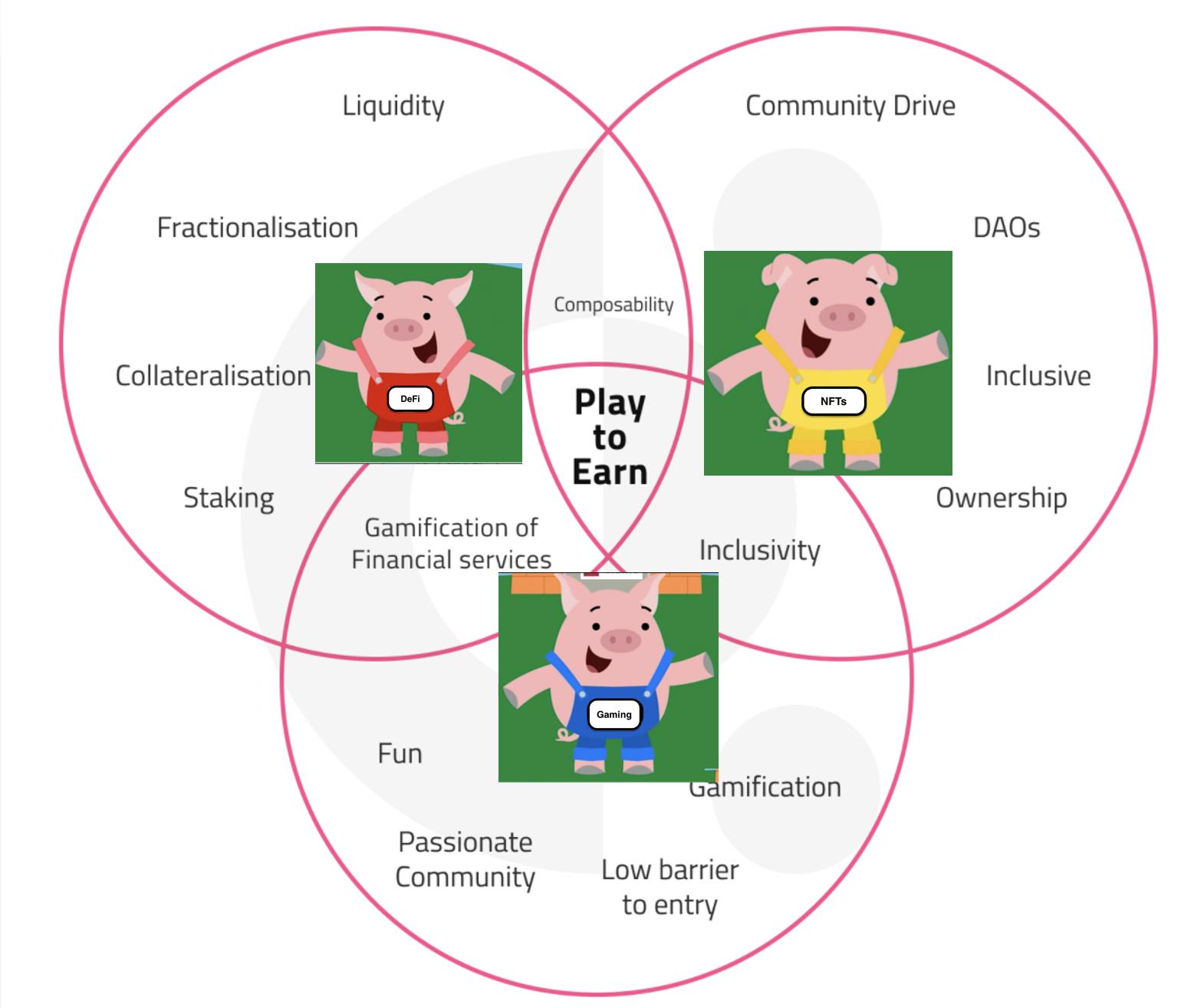

This is how me and my piglets ushered in the revolution of GameFi, a portmanteau of "game" and "finance" which runs on blockchain and it merges the diverse world of 'fun of games' with the passive income of finance.

Append-only distributed ledger helps gamers to have verifiable ownership of assets. Playing the game allows you to accumulate fungible tokens or in-game assets like swords, plot of lands, capes etc. represented as non-fungible tokens. Once you trade your time and skills for fungible and non fungible tokens, you can trade these assets for other crypto currencies or stable coins(then to US dollars or Indian rupees or Spanish euros) as disposable income.

I had been an avid gamer in my early days where I had wasted months playing a game but a day as this where I will be paid to play the game and feed my piglets with the passive income was unimaginable for me.

But let's take a step back and talk why it was unimaginable :

Problems of Traditional Gaming

As an User generally considered playing video games as an utter waste of time more so in monetary sense.I don't remember what happened to the assets I had won , hardest levels I had reached during my game playing days.They just disappeared once I deleted the app from my mobile and I had wasted days after days trying to complete game levels.

As a developer, the motive was to sell the product to a centralized entity. But today when you construct your game on the blockchain, you have a safe environment as a game entrepreneur or developer.They also have new options to monetize gaming.They might entice more gamers by offering additional token incentives.Developers may bypass the intermediaries (external digital marketplaces).

As a traditional game publisher business the motive was to be a monopoly, to lock down the economy and be the sole seller of goods and services and restricting all secondary sales .

Traditional Gaming industry has stumbled upon this concept of P2E in the past.

There was really a famous game called World of warcraft. There was a moment where you could trade gold in the game, play the game ,farm some gold and sell it on ebay.They were called Gold farmers. Companies in China literally employed million people to play World of Warcraft, farm the gold and sell it to people in the western markets but eventually Blizzard shut that down because it was not economically aligned with the business model of the game. Business model of the game was I charge you a monthly subscription, you pay $15 per month and I design the game such that for a n average player it would take an year to finish all the levels in the game , meanwhile I would have created another version of the game with different levels and you will hopefully play another year but instead if I create this game and in-game you buy 20$ worth gold from some gold farmer and it helps you finish the game in three months which is bad for business because you then cancel your subscription. Also they locked you in when you had to buy in-game skins, Swords , rare cape etc.

What does Blockchain bring to Gamers?

This becomes more relevant in Blockchain world with the evolution of NFTs and DeFi where you would be able to own these unique assets in your non-custodial wallets, digitally sign your transactions and exchange that sword for something else or rent it out to players who want to move to another level.And not only you sell your items but also get 5 % royalty every time that items sells.

You play.You earn.

In traditional Video Games users paid to play video games in order to earn rewards but on the blockchain gaming platforms you are rewarded for your time and effort.

But how do they monetize the game?

In PlayToEarn(P2E) games, players receive financial rewards for completing game play objectives. Players receive native tokens held within a smart contract

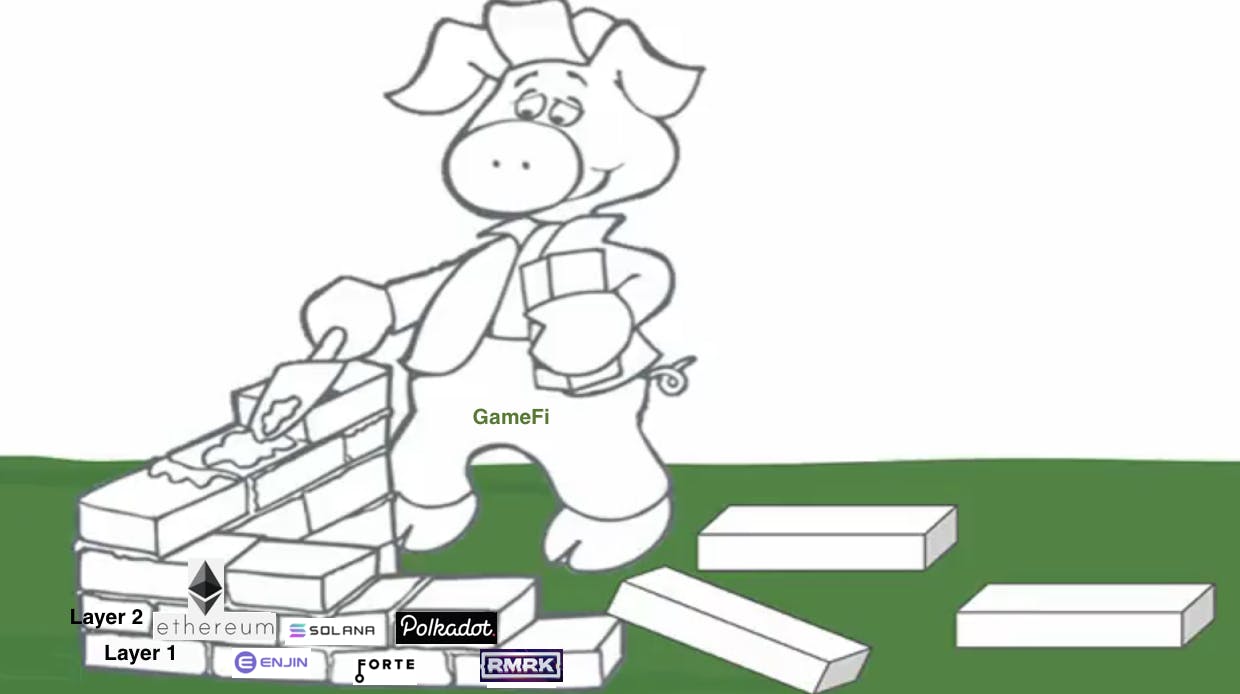

The GameFi Stack

Let's understand the tech stack of GameFi, shall we?

This is the foundation layer as you can see ,being built by my piglet and this base layer includes robust application programming interfaces (APIs), versatile software development kits (SDKs) and other development tools to help create NFT-powered projects.

Today most Blockchain support NFTs and build NFT purposed blockchain. Thinking back to early years of crypto gaming, CryptoKitties started the trend but brought out a glaring loophole about how congested traffic can get on the network when transactions for the NFT minting started which accounted for more than 25 percent on Ethereum.

Today Launchpads help facilitate bootstrapping liquidity and Initial Game Offerings(IGOs) which is a method for blockchain gaming projects to raise capital. Investors fund in the game's development in return to have vested tokens at a discount and gain privileged access to game's features before the launch date.

This intersection between blockchain technology and gaming made possible by my piglets creates a new reality for gamers but games themselves will have to be fun, addictive and they will have to come up with new business and monetisation models to compete to the quality and complexity of games that exist in the traditional gaming market. Blockchain games and models like free-to-play-to-earn may end up altering the gaming market as new economic opportunities are created.

Why most Play-to-Earn models don't work

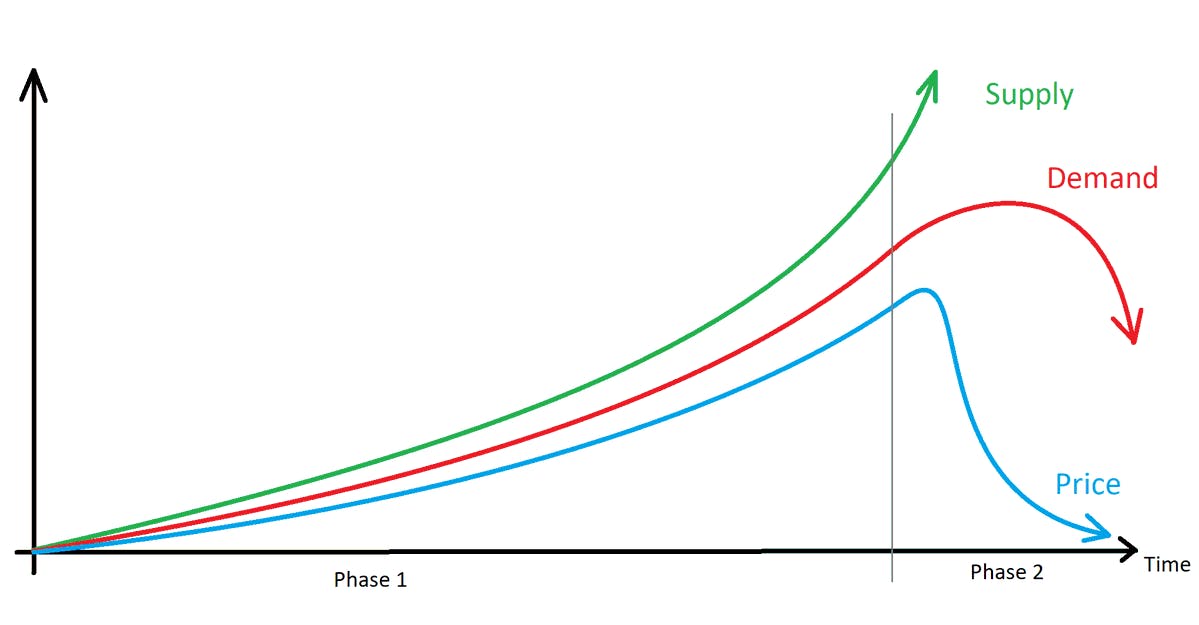

- Most Play-To-Earn models today work by rewarding NFT holders with a token. The token is burnt to redeem a new NFT in the collection which the player can either hold, rent out or sell on the market.But if we examine the connections between the supply of the NFT, the demand and the price, it will tell you that the whole inflationary nature of the entire model wreaks havoc on the long term sustainability of the project. The demand needs to increase exponentially because the market supply of NFTs increases exponentially.

- As we already know the impact Cryptokitties had on Ethereum mainnet , it became very apparent that Layer 1 Blockchain network like Ethereum was not ready for the kind of scalability that gaming industry requires, then came the layer 2 with higher level of TPS, higher scalability. But Gaming industry will test blockchain unlike NFTs and DeFis. It’s going to take great games with immense scalability that are capable of attracting and retaining millions of players who spend real money and generate real revenue.

- There is an important metric called FTUE(First Time User Experience) where gaming company or big consumer companies like Instagram, Pinterest will measure every button that you click, every message you see and they will look at drop off rate and try to minimize them. This is particularly difficult for Crypto companies because the integration of noncustodial wallet like MetaMask itself is so confusing so any application developer can't even measure the drop off rate or conversions as user need a MM wallet to use their application.

My Opinion of the future

Though it could completely change the closed world of Traditional Gaming, the problem I think is publisher who has spent all the time making a game, has very little incentive to allow items(NFTs) that are not created in the game. If I go and invest 10 million dollars to create a game and allow secondary trading and third party market places to emerge, I need to study the economic impact of that but if I just simply allow other items to be brought into my game and it makes my life difficult to sell any items in my own game, then it's a risk considering the incentive alignment but a whole new generation of game will be built around this idea of open marketplace.

The arc of DeFi will hit the gaming industry as well. The incentive algorithms will evolve similar to how it evolved from DeFi to DeFi 2.0. Games like Axie and Defi kingdoms are already losing steam .They need to come up with better tokenomics design.

There will be vampire attacks in gaming platforms similar to how Sushiswap vampire attacked Uniswap when it went to market.

Competetative/ collaborative environments will emerge.

There will need to be equilibrium in the market regarding incentive alignment for players and Game developers. The idea of collaterlization, fractional ownership, liquidity around in-game assets and NFTs in general will come sooner than later.

As a developer Sow , community building is the biggest asset I see in Web3 or gaming in particular. Before the game is even built IDOs garner a lot of attention, NFTs are generated beforehand and people owning those NFTs and token display them on Twitter, talk endlessly in Discord and hence amplify the network effect.

As a player, FreetoPlaytoEarn(F2P2E) is such a powerful concept and helps one earn a meaningful income. But what do I know, right?

This is the story of me and my three piglets and how we are going to revolutionise the world of Blockchain gaming.

And yes I maintain GameFi is going to onboard the next million users onto blockchain.

Go play some P2E games like Axie, Crabada or Defi Kingdom for yourself and HODL some tokens into your non custodial wallet or even better go BUIDL.

Also if you are reading this, go share your knowledge and participate in The Epic Hashnode Writeathon even if you are a first time aspiring technical writer like me.

It would be great if you could leave some feedback for this first time writer(even if this article demanded to be a lil wordy) and show me some love if you found this article helpful. I will keep bringing you articles which are at the intersection of BUIDL(development) and HODL(finance).

#LFG🚀